Accessibility Quick Links

- Skip to Content

- Skip to Navigation

- Skip to Sub Navigation

- Small Business

SMALL BUSINESS BANKING

Our Small Business Administration (SBA) loan program can help provide the financing you need to start or expand your business.

Use an SBA loan to help grow your business

Insightful expert advice.

Our SBA lending team is here to support you with any challenges your business may be facing. Plus, we're ranked among the top 10% of SBA lenders nationally. 1

Flexible borrowing options

Our SBA loans give you favorable options to help your small business succeed, such as flexibility in equity investment, funds for operating costs and more.

Longer repayment terms

We want your business to excel. Get lower monthly payments to help you save or use capital for your business needs.

What's an SBA loan?

SBA loans are provided through participating lenders, such as CIBC, to provide flexible terms to small businesses across the country. To qualify for SBA loans, you must complete an SBA questionnaire, be of good character, and have good credit history. You must also show that you're able to repay the loan. and in some cases, have the required equity injection in your business.

Choose the right SBA loan for you

A loan that's used for business acquisition, real estate purchases, equipment, expansion, inventory, leasehold improvements, debt refinance and working capital.

- Borrow up to $5 million

- 7-to 10-year term for most business purposes and up to a 25-year term for real estate

- Competitive low interest rates

Eligibility

- For-profit company based in the US

- Demonstrate a business need for a loan

- Not delinquent on any exist debt to the US government

- Have a net worth of less than $15 million

- Have an average net income of $5 million or less (after income tax) for the two years preceding your application

A loan for for real estate or equipment where the bank lends 50% of the cost. The Certified Development Companies (CDC) covers up to 40% and the borrower contributes 10% in equities.

- Borrow up to $5 million in lending from the CDC

- 10-year term, 20-year term and 25-year term

SBA Express

A loan that's used for revolving lines of credit or term loans. It's a quick and easy way to receive government-guaranteed financing for your business.

- Borrow up to $500,000

- Up to a 10-year term

Want more information?

The U.S. Small Business Administration provides business insights and more details about funding programs. Visit their website to learn more about SBA loans Opens in a dialog. .

Interested in an SBA loan?

Fill out the form and our SBA lending team will get back to you within 2 business days.

California residents, learn about the California Privacy Policy

A relationship-based checking account that provides incentives for business owners and executives who maintain business and personal checking accounts at CIBC.

Key features

- Up to $25 of foreign-bank ATM fees refunded per monthly statement cycle 1

- Remote deposit capture available

- Wire services available

- Includes access to two executive personal checking accounts

- ACH services available

No fee with $10,000 monthly or $25,000 combined daily balance for select business and personal accounts 2 , or $25 per month.

Set up your business for success

Count on expert advice

We're proud to be in the top 10% of all SBA lenders in the US. 1 You'll have a team of specialists, including a Relationship Manager, Portfolio Manager and Client Specialist, dedicated to help you with your business goals and needs. Together, we can help keep your business on the right track.

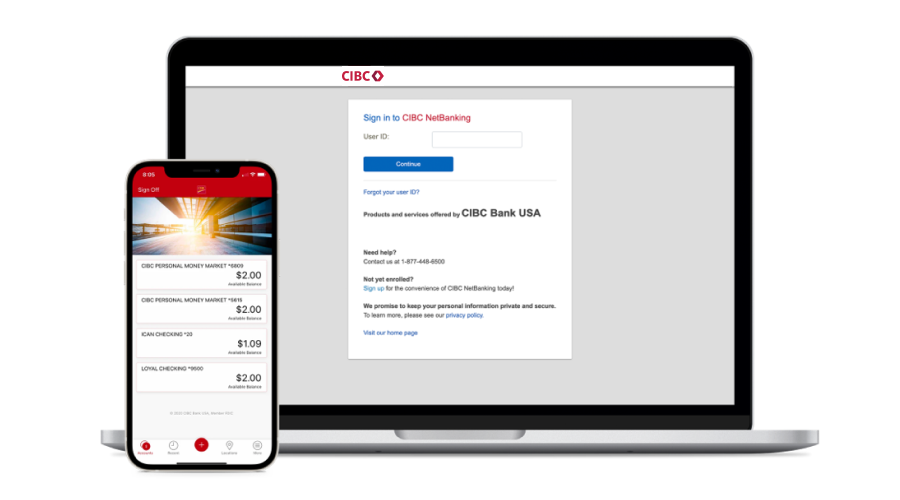

Manage your finances in one place

Our comprehensive suite of services to manage your cash and liquidity are delivered through an intuitive online banking system, Business NetBanking (BNB), where you can view balances and transactions, initiate payments, manage Positive Pay exceptions and more, all in one portal.

Learn more about our treasury management

Our small business success stories

7(a) loan used to buy out a partner and purchase real estate for a spice manufacturer in Illinois.

7(a) loan used to buy equipment for a technology security services company in Ohio.

7(a) loan used to acquire a home care business in Wisconsin.

Connect with us

Select your country and language.

- English United States English

- English Canada English

- Français Canada Français

By selecting Canada as your region, you will leave the CIBC USA Region site and enter a site of an affiliated CIBC entity. CIBC affiliates may have a different privacy policy. Affiliates are responsible for the products, services, and content on their sites. Any deposit accounts or products that may be offered by affiliates of CIBC Bank USA, which are not FDIC Members, will not be FDIC insured.

Cookie notice

CIBC uses cookies to understand how you use our website and to improve your experience. This includes personalizing CIBC content on our mobile apps, our website and third-party sites and apps. To learn more about how we do this, go to manage my advertising preferences .

Accessibility Quick Links

- Skip to Online Banking

- Skip to Content

- Skip to Navigation

Are you sure you want to delete this saved card number?

- How We Help

Business Owners and Entrepreneurs

CIBC Private Wealth

We understand how busy it can get while running a business. With our tailored approach, we'll help you define your personal wealth plan while you focus on your day-to-day responsibilities.

Here are some services that might be useful to you:

Business succession planning.

Prepare your business succession plan with our help, whether you’re contemplating a transfer of your business to family members or existing management, or selling to an outside party.

Tax and estate advisory

Benefit from specialized tax strategies customized to your business’ needs. Also gain expert guidance from your wealth advisor so you can secure your legacy with confidence and precision.

Full-service and investment advisory

Gain access to a broad range of wealth management strategies for your business, including asset management, structured solutions, alternative investments, traditional bonds and equities.

Retirement and cash flow planning

Work with your advisor, along with a team of professionals to develop cash flow strategies and to find ways to generate income for you and your loved ones through retirement.

Visit Our Solutions, for a full list of our services available exclusively to our clients. Explore all of our services .

CIBC Women’s Circle

CIBC Women’s Circle provides curated access to resources, opportunities and experiences designed to provide financial advice and expertise to help you make informed decisions and achieve the wealth goals you have for yourself and your business.

Meet with a CIBC Private Wealth advisor

Tell us about yourself and your wealth goals. We’ll match you with an advisor to offer tailored advice for your unique financial needs.

Curated expertise and insights for you

Discover other unique solutions, individuals and families.

Find unique wealth solutions for you and your family.

Professionals and executives

Get comprehensive solutions for your company.

Select your country and language

- English United States English. Opens in a new window.

Please note: Multilanguage sites do not provide full access to all content on CIBC.com. The full CIBC website is available in English and French.

IMAGES

COMMENTS

The six sections you need to develop for a clear and comprehensive business plan, from executive summaries to financial projections. ... Small Business 101 ... and communications consultant based in Toronto, Ontario, who works with clients across industries. Working with CIBC Business Banking, Lauren supports content development for online ...

Be proactive and don't forget to follow up with your advisor within the right time frame. Communicate with your advisory team and take advantage of your relationships with your investors, business partners and CIBC business advisor. Updating your business plan on a quarterly basis is a great practice for staying on track of your business growth.

Develop your plan 6 CIBC Small Business Start Strong Program. CIBC Small Business Start Strong Program 7 8 critical factors that can drive success Along with your idea, one of the most important pieces of information in your business plan is the knowledge you

CIBC 1 offers simplified products, transparent terms and a dedicated team so that you can spend more time on your business and less time on your banking. We get to know you, and together develop an approach tailored for your business needs — delivering the right solutions now and anticipating ways to capitalize on future opportunities.

Send up to $100,000 to over 130 countries with a $0 transfer fee † with your CIBC Business Account and earn up to $1,100 cash back ... Start or expand your small business with a loan from the Government of Canada and CIBC. ... You'll increase your chances of getting approved if you have a good credit score and a detailed business plan. Get ...

Send up to $100,000 to over 130 countries with a $0 transfer fee † with your CIBC Business Account and earn up to $1,100 cash back ... CIBC ranked #1 for Small Business Banking Customer Satisfaction by J.D. Power 2 2 years in a row. WELCOME TO CIBC BUSINESS BANKING. How can we help you today?

Home > Small Business Advice Centre > ... Complete the fields below to download your CIBC Start Strong Planning Guide for Business. First name. Last name. Phone number. Extension. Postal code. I'd like to receive further resources, updates and special offers from CIBC Business Banking.

business plan is essential if you want to attract investors. How to complete your guide ... The CIBC FirstCaribbean Small Business Resourse Centre is a simplified tool that provides general information only, and reflects the information that you have inputted. This CIBC FirstCaribbean Small Business Resource Centre is not a loan qualifier.

A relationship-based checking account that provides incentives for business owners and executives who maintain business and personal checking accounts at CIBC. Key features Up to $25 of foreign-bank ATM fees refunded per monthly statement cycle 1

Prepare your business succession plan with our help, whether you're contemplating a transfer of your business to family members or existing management, or selling to an outside party. Tax and estate advisory. ... CIBC Women's Circle provides curated access to resources, opportunities and experiences designed to provide financial advice and ...