PAYING FOR COLLEGE College Financing Lessons and Worksheets

Our Paying for College section provides a comprehensive suite of educational materials to enlighten students on the intricate details of funding their tertiary education. These encompass worksheets, lesson modules, interactive resources, and insightful activities on the financial nuances of pursuing higher education.

Post-high school education presents a myriad of considerations for teenagers, with the financial aspect being paramount. The escalating costs of college necessitate students to evaluate the varied financing mechanisms available to them. Nevertheless, the silver lining remains; individuals with a college degree typically have a higher earning potential than those limited to a high school qualification.

Navigating the financial landscape of higher education often marks the inauguration of significant financial decisions for many. Contemplating student loans? It's essential to understand the intricacies before committing. And once the academic journey concludes, how does one go about repaying such debts? Is a debt-free college experience even feasible?

Delve into our curated lessons to gain a holistic perspective on financing your college education. At Money Instructor's College Financing section, we aim to empower students with the knowledge to make informed financial choices and approach their educational journey with assurance.

Paying for College Lessons and Worksheets

STUDENT LOANS BASICS LESSON

Student Loans 101 | The Basics Lesson

A lesson about about student loans, distinguishing between federal and private options, and understanding repayment strategies. Students gain knowledge on making informed decisions for education financing and avoiding potential pitfalls. Discover the differences between fixed and variable interest rates, as well as the ins and outs of the main federal loan types: Direct Subsidized, Direct Unsubsidized, and Direct PLUS loans. Delve into pitfalls and risks associated with student loans and understand why it’s crucial to consider alternative education funding options. An introduction to the tools to navigate the complexities of student loan borrowing and repayment.

College Budget

Many college students discover too late that they need to learn how to budget their money. Use this budget lesson plan and worksheet on the subject of college budgeting to help teach related principles.

ADDITIONAL LESSON RESOURCES

Paying for College

Students will explore different ways to pay for college tuition and fees, learn about federal grants and loans, private loans and the 529 education savings plan. By exposing students to the various options they have, the lesson will help students feel more empowered about where they can go for education and how to pay for it.

How Will I Pay for College?

Students will learn about current trends in student borrowing and determine a reasonable debt load. College costs have escalated over the past two decades, and more and more students are relying on student loans to cover the costs. Therefore, it is important to carefully consider the costs of college, your anticipated career income, and how to best finance those college expenses.

The Real Cost of College

This lesson teaches high school students the basics of budgeting, including understanding how revenue and expenses interact. Students learn about budgeting for college expenses and apply what they learn to real-life scenarios. They learn about a college student who consults with a financial planner to help him with strategies to manage his budget. Students create different budget scenarios reflecting what it really costs to go to college, using online resources that they research independently.

Know More No Less - How To Get EXACTLY What You Need Financially To Go To College

These lessons enable educators to quickly teach students basic skills for seeking financial aid. The lessons encourage students to better understand the basic financial requirements of attending college. Students are also encouraged to minimize their loan requirements by seeking non-loan sources to finance their post-secondary education.

Options for Paying for College: Loans and Grants to Consider Paying for college is stressful in any situation, but with economic hard times facing many people, it becomes even more important to look for options that can help you to get your college student through school, or help you to pay for your own schooling costs. Competition for resources to pay for school is fiercer than ever, which means that students need to act quickly and put forth his or her best offer.

529 College Savings Plans This state-sponsored plan, the 529 college savings plan, available in every state, lets you, grandparents, relatives, or anybody else contribute at any time for saving for college. The interest is all tax-free, and when the student draws out money for college, it is tax-free as well.

Paying for College with Student Loans Not many students are fortunate enough to have funds ready and available as they graduate from high school. Many college and university candidates have no choice but to apply for a loan. For many, this means an expensive bank loan, but those who have truly done their homework know that a government student loan is the best answer.

Direct Loans for Students Direct Loans provided by the Department of Education is a Federal Student Aid, (also referred to as FSA) program. Applying for Direct Loans is a simple process. To apply for a Direct Loan students need to complete one application, the FAFSA (Free Application for Federal Student Aid).

The Problem of Unpaid Student Loans Many students take advantage of government loans. With substantial loans, they are able to complete their studies without the worry of a financial burden, knowing that when they graduate and find employment, they can then make arrangements for repaying the loan. Unfortunately many find that their plans do not materialize in the way they had predicted, and a number of unforeseen circumstances can prevent them from doing so.

Back to more Earning and Spending Worksheets and Lesson Plans

More Teaching Personal Finance Lessons

© Copyright 2002-2024 Money Instructor. All Rights Reserved.

- Rating Count

- Price (Ascending)

- Price (Descending)

- Most Recent

Does education pay worksheet

Where Does It Go - Task Box Cards - Special Education Life Skills

Wh- Questions: Describe a Scene, Part 4 ( Paid , 10 scenes)

Judges of Israel Bible Lessons BUNDLE Worksheets Coloring Books Crafts and Games

The Thief of Always by Clive Barker Chapter Worksheets , Review Game, & Test Unit

Wh- Questions: No Prep Freebie! Describe a Scene (Print and Go Worksheets )

Sales Tax Worksheets 2 Differentiated Levels

Safety Scenarios Life Skills: Fire Internet First Aid Safety Signs Worksheets

Health Insurance: Who Should Pay the Bill?? (Health Sciences/Nursing)

Women of the Bible Worksheets Bundle

Art — Graphic Artist & Design: Scavenger Hunt Worksheet Lesson Activity

Consonant Digraphs - Lessons, Worksheets , Games, Word Work, Word Lists, Digital

Real World Math Next Dollar Up Worksheets and Word Problems Summer BBQ

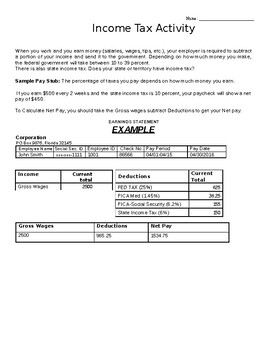

Income Tax (Calculate your Pay )

How much does the office supplies cost? task box cards - Special Education

Excise Tax Wedge Worksheet

The Thief of Always by Clive Barker Chapter 5 Worksheets /Assessment

Improve Vocabulary Worksheets : Replace the word eat (Age 7-11)

Faith-Based Teacher Guide - Bible & Christian Application Paying Attention Unit

Agriculture Floriculture, Horticulture Mega Resource Bundle #1

Agriculture Bundle #2 Resources for Horticulture, FFA & Science

Crash Course Economics #23 - Economics of Education

Mars: One Day on the Red Planet Student Comprehension Check

Eudora Welty, "A Worn Path"

Apollo: Missions to the Moon - National Geographic - Student Comprehension Check

- We're hiring

- Help & FAQ

- Privacy policy

- Student privacy

- Terms of service

- Tell us what you think

IMAGES

COMMENTS

Education Pays . Grade Level(s): 11 - 12 . Key concepts: Income and earning power . Educational achievement and impact . Employment trends . Poverty rate . Objectives: The source of household income and the potential for wealth accumulation for the majority of Americans is earnings (wages and salaries).

Step 6 : Have students complete the worksheet "Education Pays." Depending on the levels of the students, the worksheet can be done with the teacher leading the class or in small groups. The worksheet could be completed again independently at a later date for the students' portfolios. Step 7 : Review the worksheet with the students.

Gross pay is the amount people earn per pay period before any deductions or taxes are paid. Net pay is the amount people receive after taxes and other deductions are taken out of gross pay. 6. Explain that one tax people pay is federal income tax. Income tax is a tax on the amount of income people earn. People pay a percentage of their income ...

Students' answers on their worksheets and during discussion can give you a sense of their understanding. This answer guide provides possible answers for the "Saving for post-secondary education" worksheet. Keep in mind that students' answers may vary. The important thing is for students to have reasonable justification for their answers.

2. Distribute Fact Sheet 1 and ask class to read the information to find correct answers to the pretest. They should underline or highlight sentences that contain the facts to support correct answers. 3. Show the PowerPoint pretest again or go over Handout 1. Discuss correct answers by using the answer key and reviewing

Annuities Practice Problem Set 2 Future Value of an Annuity 1. On January 1, 2010, you put $1000 in a savings account that pays 61 4 % interest, and you will do this every year for the next 18 [note this correction from the original problem] years withdraw the balance on December 31, 2028, to pay for your child's college education.

Use this budget lesson plan and worksheet on the subject of college budgeting to help teach related principles. ADDITIONAL LESSON RESOURCES. Paying for College. Students will explore different ways to pay for college tuition and fees, learn about federal grants and loans, private loans and the 529 education savings plan.

4.4K. Answer sheets are available to all of our Premium members. Many of our worksheets for third grade and above have answer sheets. We're working toward having answer sheets for all worksheets for third grade and above, so check back soon if the answer sheet you're looking for isn't available today.

Browse educational resources created by Education Answers in the official Teachers Pay Teachers store. Log In Join. Cart is empty. Total: $0.00. View Wish List. View Cart. Grade. ... Education Answers. Rated 4.7 out of 5, based on 8 reviews. 4.7 (8) 5 Followers. Florida, United States ... 35,000 worksheets, games, and lesson plans. Vocabulary ...

Where Does It Go?- Task Box cardsWHAT'S INCLUDED?4 PDF's 14cards 2 directions for containeranswer keyWHAT'S INCLUDED?Cards to Identify where things belong in the house.HOW DO I US